kakao <- read.csv("kakaodata_1206.csv", fileEncoding = "ISO-8859-1")- 데이터 source: http://data.krx.co.kr/contents/MDC/MDI/mdiLoader/index.cmd?menuId=MDC0201020203

참고 https://velog.io/@isitcake_yes/mlarimastockprediction

head(kakao)| ÀÏÀÚ | Á... | X.ëºñ | µî.ô.ü | X.Ã.. | X.í.. | Àú.. | X.Å.... | X.Å...ë.Ý | X.Ã..ÃÑ.. | X.óÀåÁÖ.Ä.ö | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 1 | 2023/12/06 | 50900 | 100 | 0.20 | 50700 | 51100 | 50200 | 735503 | 37302792200 | 2.262484e+13 | 444495970 |

| 2 | 2023/12/05 | 50800 | 0 | 0.00 | 50700 | 51200 | 50200 | 1142447 | 57992282100 | 2.258040e+13 | 444495970 |

| 3 | 2023/12/04 | 50800 | 1100 | 2.21 | 49800 | 51300 | 49750 | 1785113 | 90624610300 | 2.258040e+13 | 444495970 |

| 4 | 2023/12/01 | 49700 | -800 | -1.58 | 50400 | 50400 | 49650 | 1105367 | 55174771850 | 2.209145e+13 | 444495970 |

| 5 | 2023/11/30 | 50500 | 0 | 0.00 | 50200 | 50900 | 50000 | 1613598 | 81271347200 | 2.244705e+13 | 444495970 |

| 6 | 2023/11/29 | 50500 | -600 | -1.17 | 50800 | 51300 | 50100 | 1284120 | 65153113600 | 2.244705e+13 | 444495970 |

colnames(kakao) <- c("일자","종가","대비","등락률","시가","고가","저가","거래량","거래대금","시가총액","상장주식수")kakao <- kakao[order(kakao$일자),]

rownames(kakao) <- NULL

head(kakao)| 일자 | 종가 | 대비 | 등락률 | 시가 | 고가 | 저가 | 거래량 | 거래대금 | 시가총액 | 상장주식수 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| <chr> | <int> | <int> | <dbl> | <int> | <int> | <int> | <int> | <dbl> | <dbl> | <int> | |

| 1 | 2023/01/02 | 52700 | -400 | -0.75 | 53600 | 53800 | 52400 | 887667 | 46979376500 | 2.347313e+13 | 445410387 |

| 2 | 2023/01/03 | 53300 | 600 | 1.14 | 52400 | 53500 | 51400 | 1420569 | 74588286800 | 2.374037e+13 | 445410387 |

| 3 | 2023/01/04 | 55700 | 2400 | 4.50 | 53200 | 56000 | 53100 | 2241411 | 123346180300 | 2.480936e+13 | 445410387 |

| 4 | 2023/01/05 | 57700 | 2000 | 3.59 | 55800 | 58200 | 55700 | 3046064 | 175103778900 | 2.570018e+13 | 445410387 |

| 5 | 2023/01/06 | 57200 | -500 | -0.87 | 57200 | 58000 | 56500 | 1420345 | 81326211100 | 2.547747e+13 | 445410387 |

| 6 | 2023/01/09 | 61100 | 3900 | 6.82 | 58700 | 61200 | 58300 | 3482961 | 208443993900 | 2.721457e+13 | 445410387 |

- 시계열 데이터 분석을 하기 위해, 일단.. 일자와 종가만 선택하자.

data <- kakao$종가data <- ts(data)

head(data)

A Time Series:

- 52700

- 53300

- 55700

- 57700

- 57200

- 61100

해당 데이터는 주식 데이터이기 때문에 중간에 공휴일로 인해 일자가 NA값이 있으므로 ts객체를 통해 그냥 해부림..

데이터가.. 아주 그냥 별로다

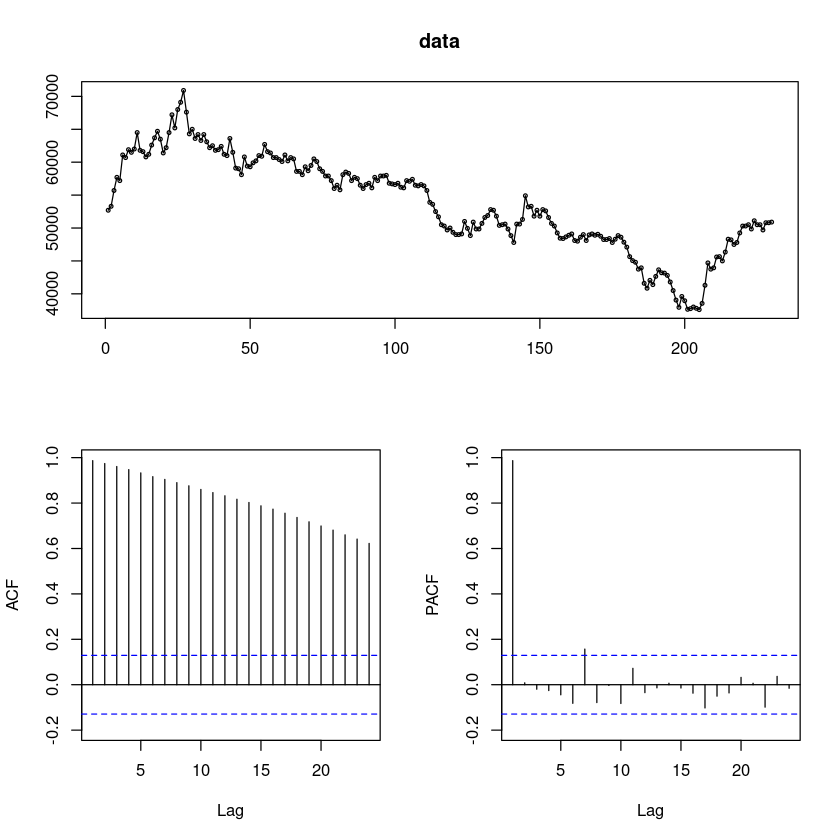

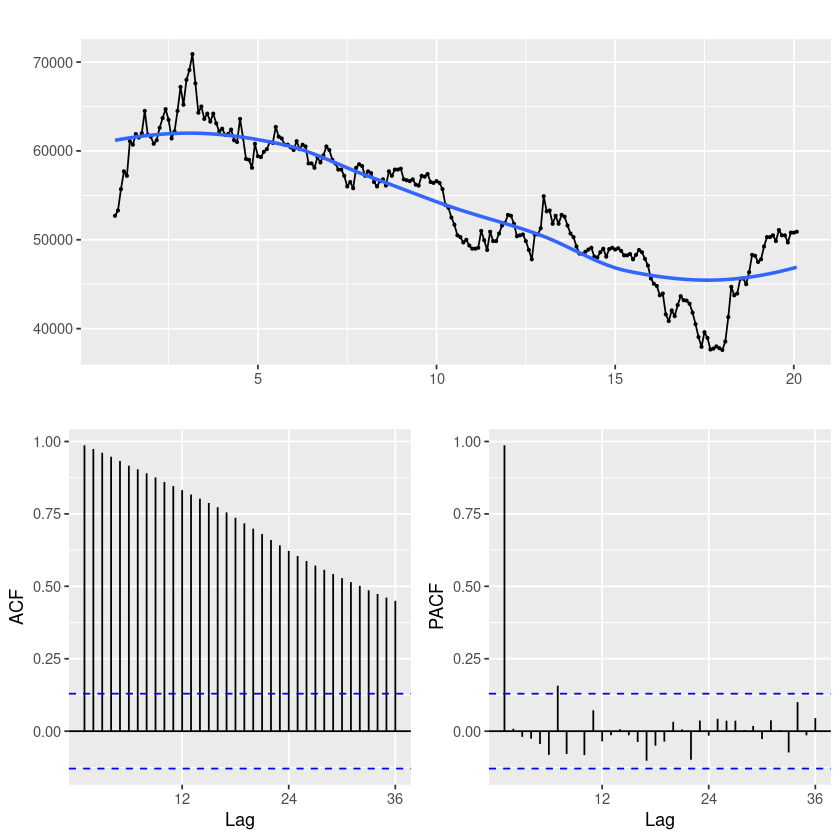

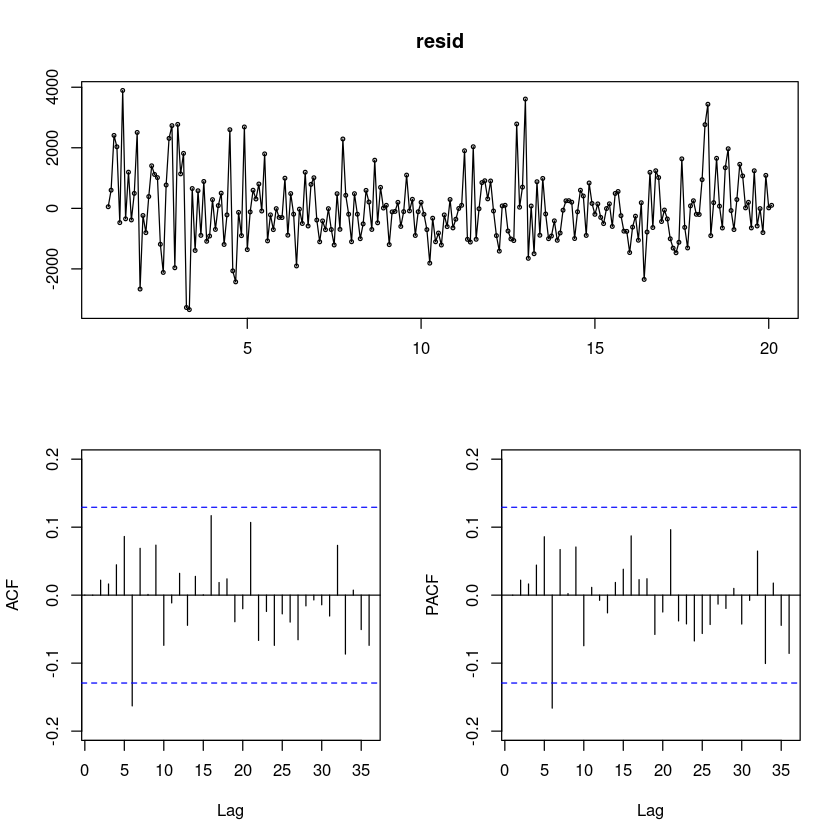

forecast::tsdisplay(data)

주식데이터가 평균이 일정하지 않은 비정상성의 특징을 보인다.

ARIMA의 d차수가 1이상일 것이다.

계절성분이나 다른 특징은 보이지 않는다.

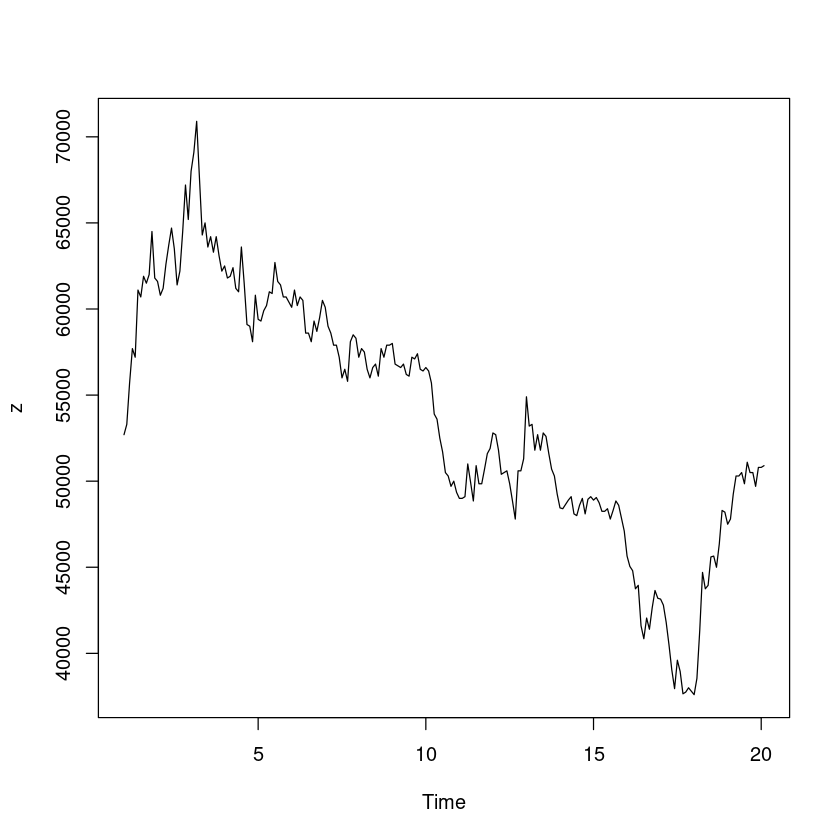

plot.ts(z)

mean(z)

53663.0434782609

par(mfrow=c(1,2))

acf(z, lag.max=60)

pacf(z, lag.max=60)

ACF가 천천히 줄어들고.. pacr가 첫번째 시차만 살아있고 나머지는 0이다.

시도표를 확인했을 때 계절성분은 없어보이고.. 추세는 조금 있어 보인다.

AR(1)모형..?

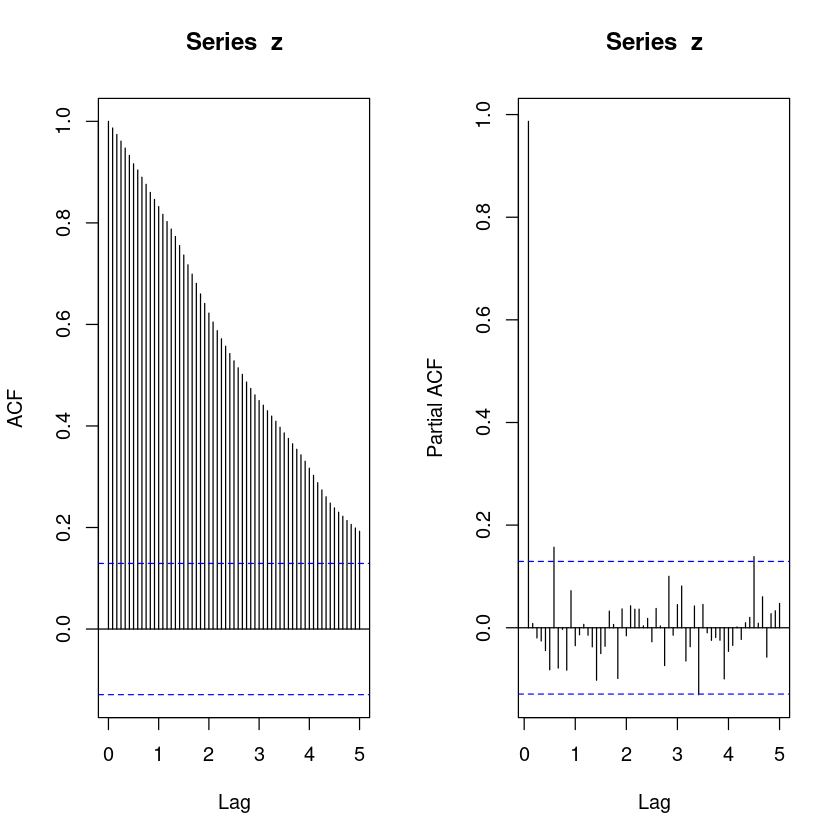

forecast::ggtsdisplay(z,

smooth=T)`geom_smooth()` using formula = 'y ~ x'

- ACF가 천천히 감소한다. 확률적 추세가 있어보인다.

fUnitRoots::adfTest(z, lags = 1, type = "c")

fUnitRoots::adfTest(z, lags = 30, type = "c")

fUnitRoots::adfTest(z, lags = 60, type = "c")

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 1

STATISTIC:

Dickey-Fuller: -1.1594

P VALUE:

0.6251

Description:

Wed Dec 6 16:27:38 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 30

STATISTIC:

Dickey-Fuller: -1.2253

P VALUE:

0.6005

Description:

Wed Dec 6 16:27:38 2023 by user:

Title:

Augmented Dickey-Fuller Test

Test Results:

PARAMETER:

Lag Order: 60

STATISTIC:

Dickey-Fuller: -0.2159

P VALUE:

0.9282

Description:

Wed Dec 6 16:27:38 2023 by user: - 유의확률이 0.05보다 크므로 귀무가설을 기각할 수 없다. 즉 차분이 필요하다.

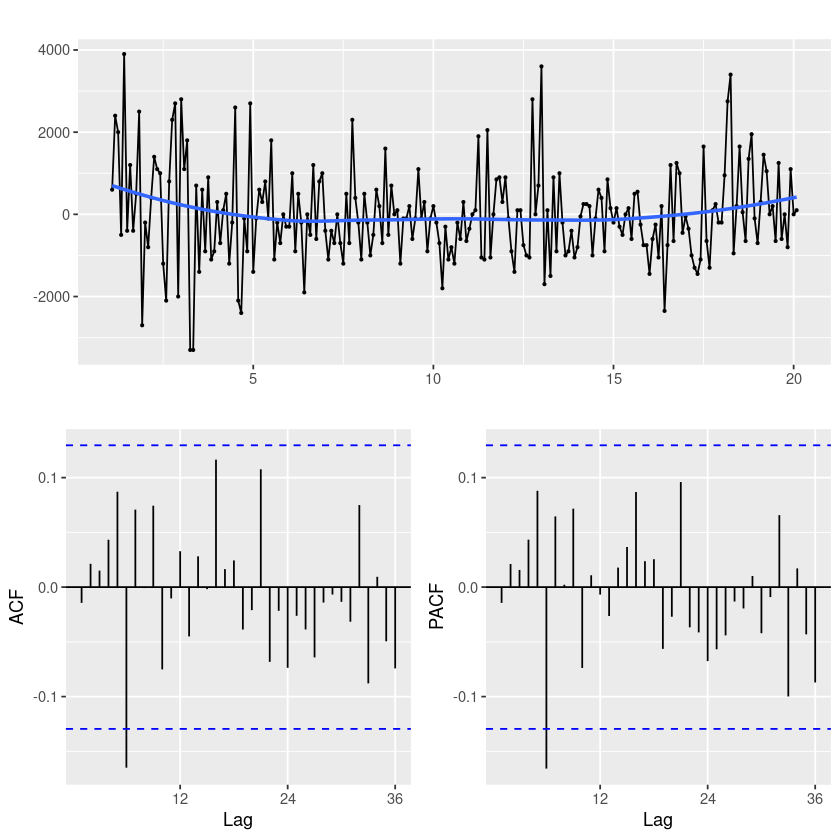

forecast::ggtsdisplay(diff(z),

smooth=T)`geom_smooth()` using formula = 'y ~ x'

0을 중심으로 움직인다.

pacf가…감소하는 거 같은데………………………

acf가..그림이 잇앙해.ㅐ.

## mean : H0 : mu = 0

t.test(lag_z)

One Sample t-test

data: lag_z

t = -0.10283, df = 228, p-value = 0.9182

alternative hypothesis: true mean is not equal to 0

95 percent confidence interval:

-158.4750 142.7545

sample estimates:

mean of x

-7.860262 - p-value = 0.9182로 평균이 0이다.

- 차분한 모형(평균f취함)

fit1 <- arima(lag_z, order=c(0,0,1), include.mean = F)

fit1

Call:

arima(x = lag_z, order = c(0, 0, 1), include.mean = F)

Coefficients:

ma1

-0.0137

s.e. 0.0646

sigma^2 estimated as 1331943: log likelihood = -1939.63, aic = 3883.27- 원 모형

fit <- arima(z, order=c(0,1,1))

fit

Call:

arima(x = z, order = c(0, 1, 1))

Coefficients:

ma1

-0.0137

s.e. 0.0646

sigma^2 estimated as 1331943: log likelihood = -1939.63, aic = 3883.27\(Z_t = ε_t -0.0137ε_t, \hat θ = 0.0137\)

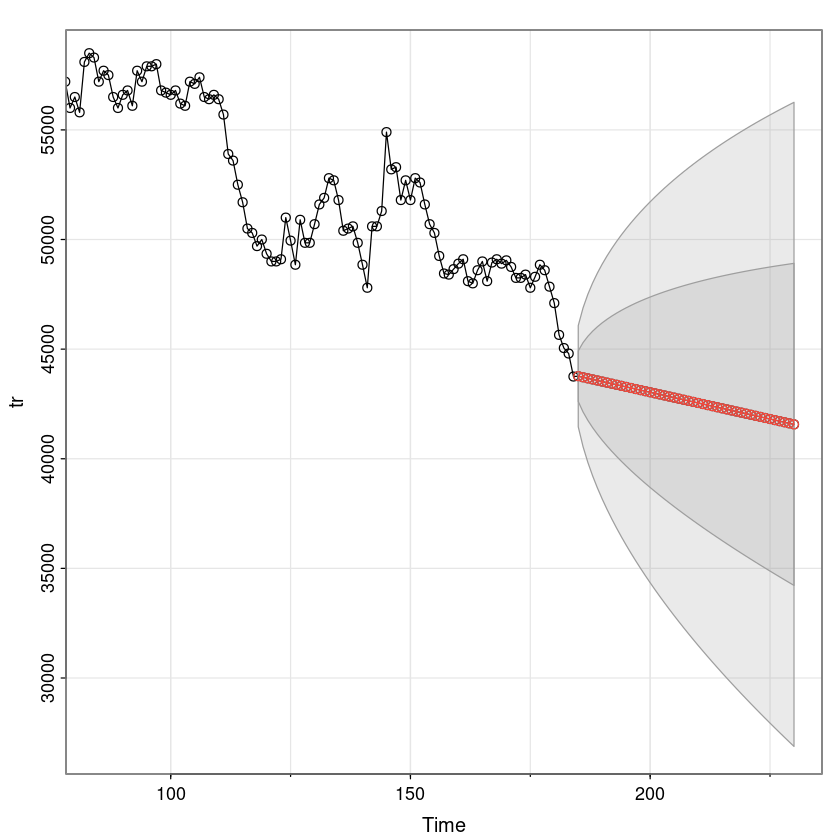

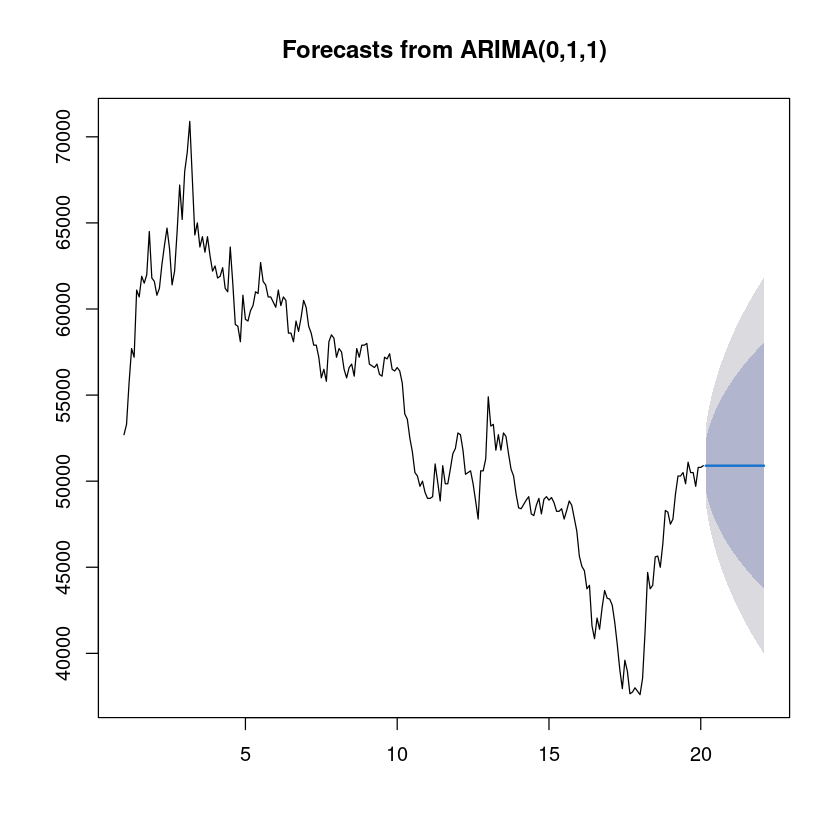

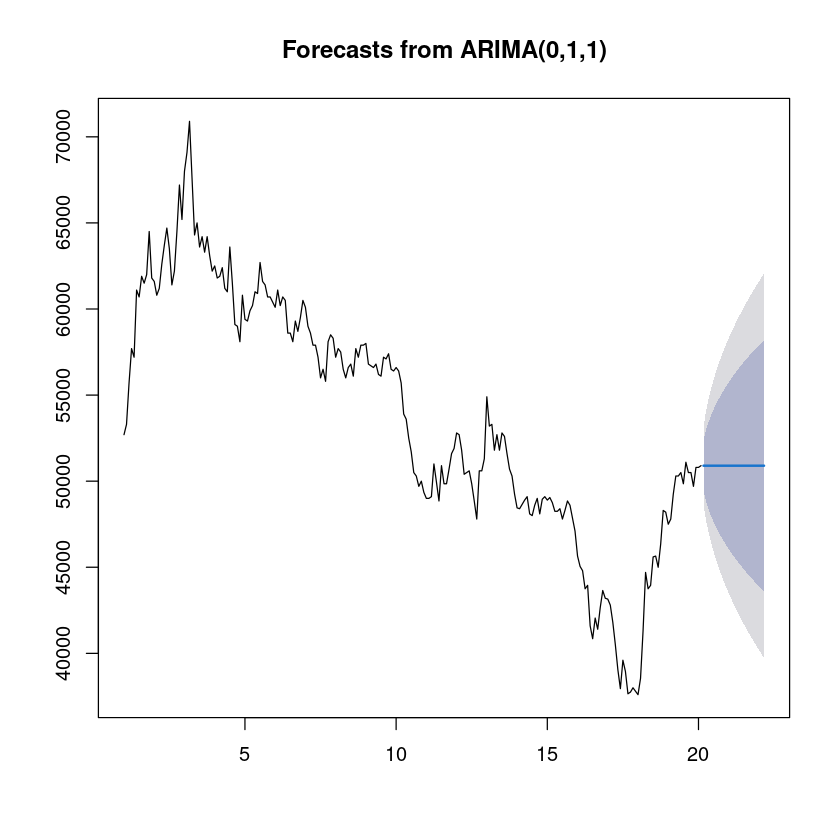

예측

fore_fit <- forecast::forecast(fit)

fore_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Mar 20 50898.63 49419.59 52377.66 48636.64 53160.62

Apr 20 50898.63 48821.22 52976.03 47721.51 54075.75

May 20 50898.63 48360.19 53437.07 47016.42 54780.84

Jun 20 50898.63 47970.87 53826.38 46421.01 55376.24

Jul 20 50898.63 47627.57 54169.68 45895.98 55901.28

Aug 20 50898.63 47317.03 54480.23 45421.04 56376.22

Sep 20 50898.63 47031.34 54765.92 44984.12 56813.14

Oct 20 50898.63 46765.35 55031.91 44577.32 57219.94

Nov 20 50898.63 46515.47 55281.79 44195.17 57602.09

Dec 20 50898.63 46279.09 55518.17 43833.65 57963.60

Jan 21 50898.63 46054.23 55743.03 43489.76 58307.50

Feb 21 50898.63 45839.35 55957.90 43161.13 58636.12

Mar 21 50898.63 45633.24 56164.02 42845.91 58951.35

Apr 21 50898.63 45434.89 56362.36 42542.57 59254.69

May 21 50898.63 45243.50 56553.76 42249.86 59547.40

Jun 21 50898.63 45058.38 56738.88 41966.73 59830.52

Jul 21 50898.63 44878.94 56918.31 41692.32 60104.94

Aug 21 50898.63 44704.71 57092.55 41425.84 60371.41

Sep 21 50898.63 44535.24 57262.02 41166.66 60630.59

Oct 21 50898.63 44370.17 57427.09 40914.21 60883.05

Nov 21 50898.63 44209.17 57588.09 40667.98 61129.27

Dec 21 50898.63 44051.96 57745.30 40427.55 61369.71

Jan 22 50898.63 43898.27 57898.99 40192.51 61604.75

Feb 22 50898.63 43747.89 58049.37 39962.52 61834.74plot(fore_fit)

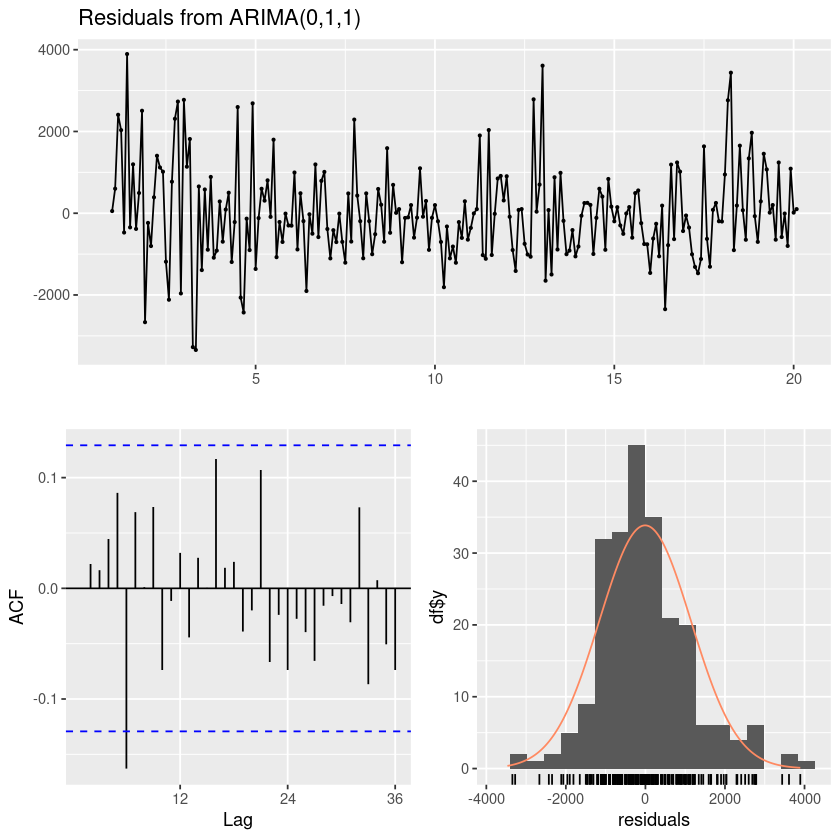

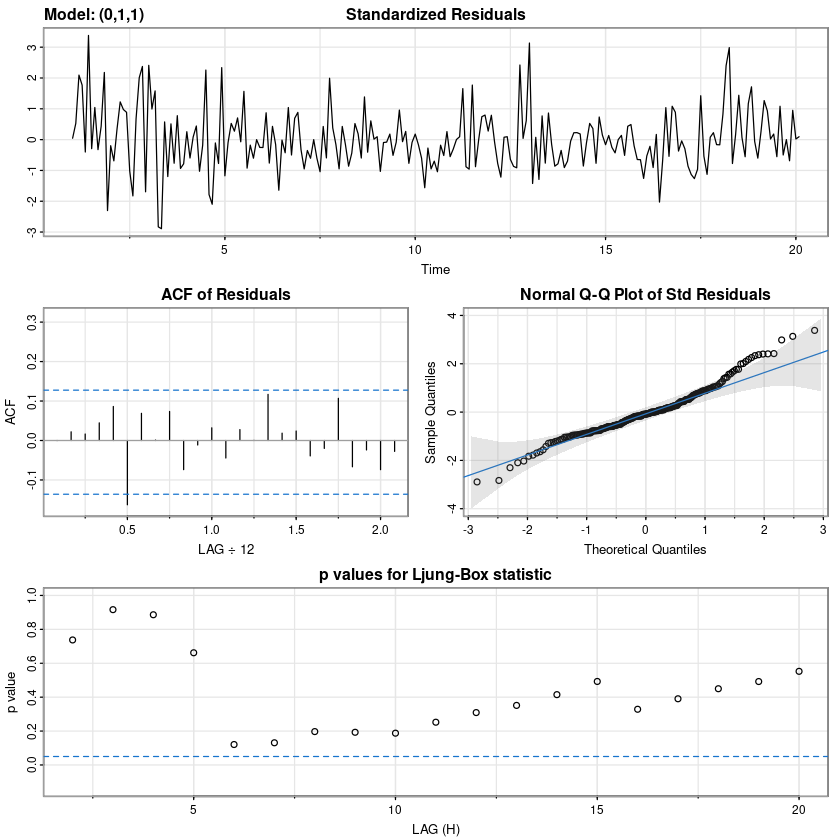

forecast::checkresiduals(fit)

Ljung-Box test

data: Residuals from ARIMA(0,1,1)

Q* = 23.178, df = 23, p-value = 0.4504

Model df: 1. Total lags used: 24

- 5번째 시차 뭐냐

resid = resid(fit)

forecast::tsdisplay(resid)

# 잔차의 포트맨토 검정 ## H0 : rho1=...=rho_k=0

portes::LjungBox(fit, lags=c(6,12,18,24))| lags | statistic | df | p-value | |

|---|---|---|---|---|

| 6 | 8.728782 | 5 | 0.1203836 | |

| 12 | 12.770020 | 11 | 0.3086222 | |

| 18 | 17.077177 | 17 | 0.4491493 | |

| 24 | 23.178420 | 23 | 0.4503932 |

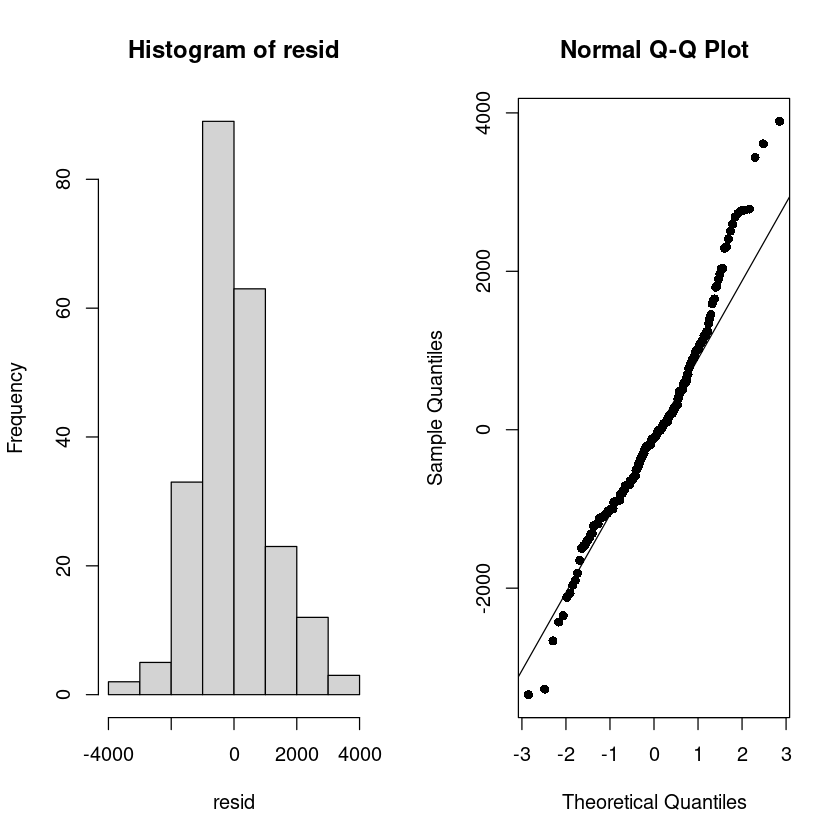

## 정규성검정

tseries::jarque.bera.test(resid) ##JB test H0: normal

Jarque Bera Test

data: resid

X-squared = 23.774, df = 2, p-value = 6.878e-06- 정규분포가 아니넹.

par(mfrow=c(1,2))

hist(resid)

qqnorm(resid, pch=16)

qqline(resid)

## 잔차 검정

astsa::sarima(z, p=0, d=1, q=1)initial value 7.051150

iter 2 value 7.051051

iter 3 value 7.051051

iter 3 value 7.051051

iter 3 value 7.051051

final value 7.051051

converged

initial value 7.051051

iter 1 value 7.051051

final value 7.051051

converged$fit

Call:

arima(x = xdata, order = c(p, d, q), seasonal = list(order = c(P, D, Q), period = S),

xreg = constant, transform.pars = trans, fixed = fixed, optim.control = list(trace = trc,

REPORT = 1, reltol = tol))

Coefficients:

ma1 constant

-0.0138 -7.9038

s.e. 0.0646 75.2190

sigma^2 estimated as 1331879: log likelihood = -1939.63, aic = 3885.26

$degrees_of_freedom

[1] 227

$ttable

Estimate SE t.value p.value

ma1 -0.0138 0.0646 -0.2130 0.8315

constant -7.9038 75.2190 -0.1051 0.9164

$AIC

[1] 16.96618

$AICc

[1] 16.96641

$BIC

[1] 17.01116

fore_fit <- forecast::forecast(fit, 25)

fore_fit Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Mar 20 50898.63 49419.59 52377.66 48636.64 53160.62

Apr 20 50898.63 48821.22 52976.03 47721.51 54075.75

May 20 50898.63 48360.19 53437.07 47016.42 54780.84

Jun 20 50898.63 47970.87 53826.38 46421.01 55376.24

Jul 20 50898.63 47627.57 54169.68 45895.98 55901.28

Aug 20 50898.63 47317.03 54480.23 45421.04 56376.22

Sep 20 50898.63 47031.34 54765.92 44984.12 56813.14

Oct 20 50898.63 46765.35 55031.91 44577.32 57219.94

Nov 20 50898.63 46515.47 55281.79 44195.17 57602.09

Dec 20 50898.63 46279.09 55518.17 43833.65 57963.60

Jan 21 50898.63 46054.23 55743.03 43489.76 58307.50

Feb 21 50898.63 45839.35 55957.90 43161.13 58636.12

Mar 21 50898.63 45633.24 56164.02 42845.91 58951.35

Apr 21 50898.63 45434.89 56362.36 42542.57 59254.69

May 21 50898.63 45243.50 56553.76 42249.86 59547.40

Jun 21 50898.63 45058.38 56738.88 41966.73 59830.52

Jul 21 50898.63 44878.94 56918.31 41692.32 60104.94

Aug 21 50898.63 44704.71 57092.55 41425.84 60371.41

Sep 21 50898.63 44535.24 57262.02 41166.66 60630.59

Oct 21 50898.63 44370.17 57427.09 40914.21 60883.05

Nov 21 50898.63 44209.17 57588.09 40667.98 61129.27

Dec 21 50898.63 44051.96 57745.30 40427.55 61369.71

Jan 22 50898.63 43898.27 57898.99 40192.51 61604.75

Feb 22 50898.63 43747.89 58049.37 39962.52 61834.74

Mar 22 50898.63 43600.61 58196.65 39737.27 62059.99plot(fore_fit)

astsa::sarima.for(z, 25, 0,1,1)- $pred

-

$seA Time Series: 3 × 12 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 20 50890.61 50882.70 50874.80 50866.90 50858.99 50851.09 50843.18 50835.28 50827.38 50819.47 21 50811.57 50803.67 50795.76 50787.86 50779.95 50772.05 50764.15 50756.24 50748.34 50740.43 50732.53 50724.63 22 50716.72 50708.82 50700.92 A Time Series: 3 × 12 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 20 1154.070 1620.915 1980.620 2284.369 2552.221 2794.516 3017.417 3224.949 3419.910 3604.341 21 3779.783 3947.436 4108.252 4263.006 4412.336 4556.775 4696.774 4832.719 4964.943 5093.737 5219.352 5342.015 22 5461.924 5579.257 5694.172

astsa::sarima.for(lag_z, 25, 0,0,1)- $pred

-

$seA Time Series: 3 × 12 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 20 -9.392518 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 21 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 -7.903833 22 -7.903833 -7.903833 -7.903833 A Time Series: 3 × 12 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 20 1154.07 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 21 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 1154.18 22 1154.18 1154.18 1154.18

8:2

train_data <- window(z, start = start(z), end = index(z)[184])

test_data <- window(z, start = index(z)[185])length(train_data)

184

length(test_data)

46

test_data| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 16 | 43950 | 41600 | 40850 | 42050 | 41400 | 42650 | 43650 | 43200 | ||||

| 17 | 43150 | 42800 | 41800 | 40500 | 39050 | 37950 | 39600 | 38950 | 37650 | 37750 | 38000 | 37800 |

| 18 | 37600 | 38550 | 41300 | 44700 | 43750 | 43950 | 45600 | 45650 | 45000 | 46350 | 48300 | 48200 |

| 19 | 47500 | 47800 | 49250 | 50300 | 50300 | 50500 | 49850 | 51100 | 50500 | 50500 | 49700 | 50800 |

| 20 | 50800 | 50900 |

astsa::sarima.for(train_data, 46, 0,1,1)- $pred

-

$seA Time Series: 5 × 12 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 16 43765.61 43716.78 43667.94 43619.11 43570.28 43521.44 43472.61 43423.78 17 43374.95 43326.11 43277.28 43228.45 43179.61 43130.78 43081.95 43033.11 42984.28 42935.45 42886.61 42837.78 18 42788.95 42740.11 42691.28 42642.45 42593.61 42544.78 42495.95 42447.12 42398.28 42349.45 42300.62 42251.78 19 42202.95 42154.12 42105.28 42056.45 42007.62 41958.78 41909.95 41861.12 41812.28 41763.45 41714.62 41665.79 20 41616.95 41568.12 A Time Series: 5 × 12 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 16 1154.524 1581.835 1916.110 2200.172 2451.537 2679.423 2889.392 3085.103 17 3269.119 3443.314 3609.112 3767.621 3919.725 4066.143 4207.469 4344.200 4476.756 4605.499 4730.740 4852.749 18 4971.765 5087.998 5201.635 5312.841 5421.767 5528.547 5633.304 5736.147 5837.179 5936.492 6034.171 6130.293 19 6224.931 6318.152 6410.017 6500.584 6589.907 6678.035 6765.015 6850.891 6935.703 7019.491 7102.291 7184.136 20 7265.059 7345.091

arima_model <- arima(train_data, order = c(0, 1, 1))

# 훈련 세트 예측

train_pred <- predict(arima_model, n.ahead = length(train_data))

# 테스트 세트 예측

test_pred <- predict(arima_model, n.ahead = length(test_data))

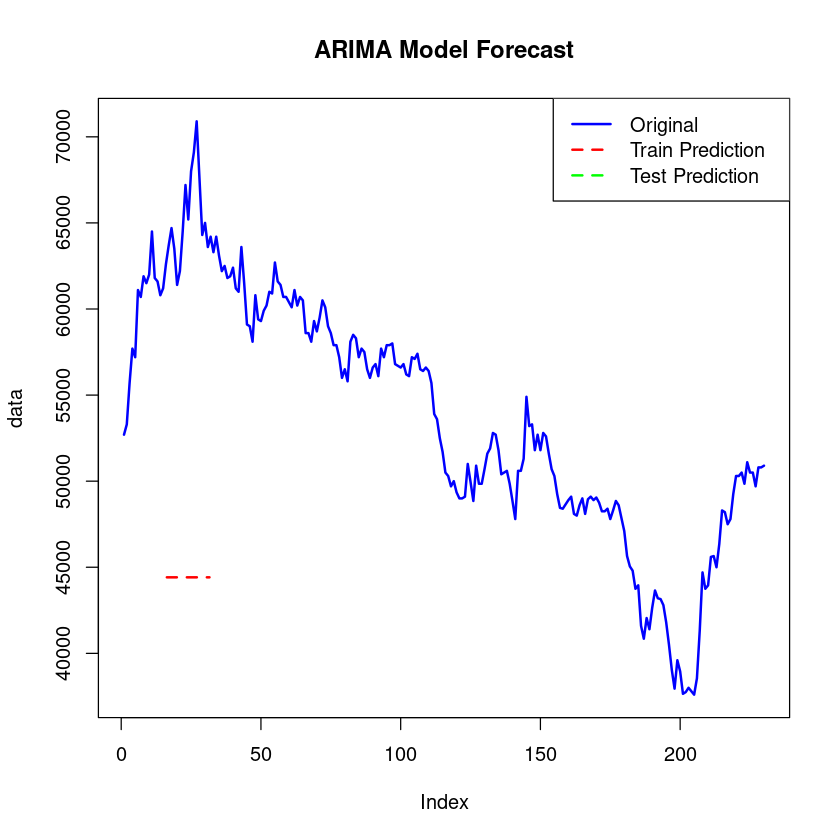

# 시각화

plot(train_data, col = "blue", type = "l", lty = 1, lwd = 2, main = "ARIMA Model Forecast")

lines(train_pred$pred, col = "red", lty = 2, lwd = 2)

lines(test_pred$pred, col = "green", lty = 2, lwd = 2)

legend("topright", legend = c("Original", "Train Prediction", "Test Prediction"), col = c("blue", "red", "green"), lty = c(1, 2, 2), lwd = c(2, 2, 2))

# ARIMA 모델 적합

arima_model <- arima(train_data, order = c(0, 1, 1))

# 훈련 세트 예측

train_pred <- predict(arima_model, n.ahead = length(train_data))$pred + diff(train_data)[1]

# 테스트 세트 예측

test_pred <- predict(arima_model, n.ahead = length(test_data))$pred + diff(train_data)[length(train_data)]

# 시각화

plot(data, col = "blue", type = "l", lty = 1, lwd = 2, main = "ARIMA Model Forecast")

lines(train_pred, col = "red", lty = 2, lwd = 2)

lines(c(rep(NA, length(train_data)), test_pred), col = "green", lty = 2, lwd = 2)

legend("topright", legend = c("Original", "Train Prediction", "Test Prediction"), col = c("blue", "red", "green"), lty = c(1, 2, 2), lwd = c(2, 2, 2))

- index가 안맞아서 위와같이 되네;; 흠..

data <- kakao$종가length(data)

230

tr <- data[1:184]

ts <- data[185:length(data)]astsa::sarima.for(tr, 46, 0,1,1)- $pred

- A Time Series:

- 43765.6102424124

- 43716.777101872

- 43667.9439613316

- 43619.1108207913

- 43570.2776802509

- 43521.4445397106

- 43472.6113991702

- 43423.7782586298

- 43374.9451180894

- 43326.1119775491

- 43277.2788370087

- 43228.4456964683

- 43179.612555928

- 43130.7794153876

- 43081.9462748472

- 43033.1131343069

- 42984.2799937665

- 42935.4468532261

- 42886.6137126858

- 42837.7805721454

- 42788.947431605

- 42740.1142910647

- 42691.2811505243

- 42642.4480099839

- 42593.6148694436

- 42544.7817289032

- 42495.9485883628

- 42447.1154478225

- 42398.2823072821

- 42349.4491667417

- 42300.6160262014

- 42251.782885661

- 42202.9497451206

- 42154.1166045803

- 42105.2834640399

- 42056.4503234995

- 42007.6171829592

- 41958.7840424188

- 41909.9509018784

- 41861.1177613381

- 41812.2846207977

- 41763.4514802573

- 41714.618339717

- 41665.7851991766

- 41616.9520586362

- 41568.1189180958

- $se

- A Time Series:

- 1154.52422170161

- 1581.83516172709

- 1916.11032543969

- 2200.17160231584

- 2451.53653450596

- 2679.4230125902

- 2889.39162814223

- 3085.10296119252

- 3269.11862457442

- 3443.31422933193

- 3609.11196588582

- 3767.62066597484

- 3919.72470756061

- 4066.1429000272

- 4207.46888090952

- 4344.19965979955

- 4476.75630167457

- 4605.49924383485

- 4730.73985602082

- 4852.74931206263

- 4971.76549991095

- 5087.99847547984

- 5201.6348186763

- 5312.84115019884

- 5421.76699864782

- 5528.54715888424

- 5633.30364780627

- 5736.14733848146

- 5837.1793350169

- 5936.49213673604

- 6034.17062983052

- 6130.2929367437

- 6224.93114746422

- 6318.15195219699

- 6410.01719119622

- 6500.58433464343

- 6589.90690315061

- 6678.03483762794

- 6765.0148257748

- 6850.89059125406

- 6935.70315063396

- 7019.49104238294

- 7102.29053154507

- 7184.13579318036

- 7265.05907720203

- 7345.09085686597